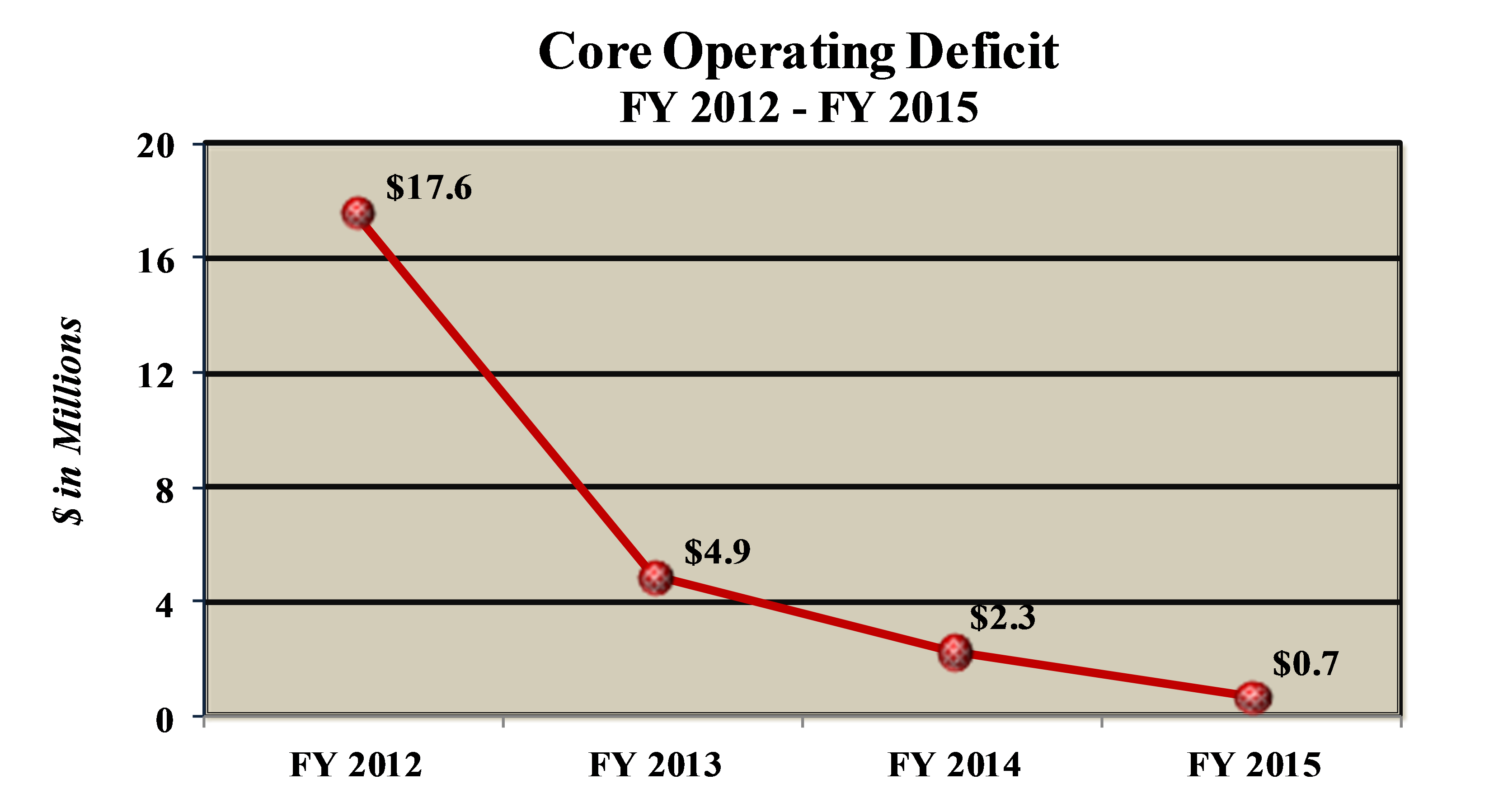

Core operating deficit shrinks to less than $1 million; balance sheet improvements continue.

Contextual Background

For the fiscal year ended June 30, 2012, the Archdiocese of Philadelphia disclosed a core operating deficit of $17.6 million. Since that time, results have improved significantly as reflected in the graph below. The core operating deficit for the fiscal year ended June 30, 2015 was approximately $700,000.

Comparative Operating Results: Fiscal Year 2015 Versus Fiscal Year 2014

These financial statements are for the entity designated as the “Office for Financial Services (OFS),” which is the official title for the majority of administrative offices and ministries located at the Archdiocesan Pastoral Center (APC). OFS provides administrative and programmatic support to the parishes, schools, and other related ecclesiastical entities of the Archdiocese. For financial reporting purposes, it is considered a wholly-owned subsidiary of the Archdiocese.

The analysis presented below compares the “Change in Net Assets Before Other Items” for FYs 2015 and 2014. The “as reported” surplus of $13.3 million in FY 2015 compares to an “as reported” deficit of $ .7 million in FY 2014. These amounts can be found in the Statement of Activities and Changes in Net Assets under the caption “Change in Net Assets Before Other Items” in the “Unrestricted” column. This analysis provides a meaningful comparison of each fiscal year after adjusting for the impact of items that are non-recurring in nature.

Note to readers: Please note that the FY 2014 analysis presented below is slightly different than what was presented in connection with our FY 2014 financial disclosures. The different presentation allows for better comparability to FY 2015’s results. Please see the endnotes to this document for a fuller explanation.

|

(in millions) |

FY 2015 |

FY 2014 |

||

|

Change in Net Assets Before Other Items |

$ 13.3 |

$ ( .7) |

||

|

|

|

|

|

|

|

Non-Recurring Items |

|

|

||

|

|

Net gain on sale of real estate assets |

(.9) |

(1.2)[i] |

|

|

|

Net assets released from restrictions |

– |

(2.3)[ii] |

|

|

|

Risk Insurance and Welfare Benefits Trust experience |

(13.5) |

(.8)[iii] |

|

|

|

Investment Losses/(Gains) |

.3 |

(.5) |

|

|

|

Adjustments in Deposit and Loan Reserves |

(1.9) |

.4[iv] |

|

|

|

Legal and Professional Fees |

.4 |

1.2[v] |

|

|

Recurring Deficit including Depreciation Expense |

(2.3) |

(3.9) |

||

|

Depreciation expense |

1.6 |

1.6 |

||

|

Recurring Deficit excluding Depreciation Expense |

$ (.7) |

$ ( 2.3) |

||

The explanations for the items noted (i) through (v) in the above table are included at the end of this document.

The “Recurring Deficit excluding Depreciation Expense” caption above represents what we refer to as our “core” (excludes items of a non-recurring nature and depreciation) run rate deficit.

The recurring core operational deficit of $.7 million for fiscal year 2015 compares favorably to the $2.3 million core operational deficit for fiscal year 2014.

It is the goal of the Archdiocese to eventually eliminate the core operational deficit.

Discussion of Other Significant Matters

In connection with our recent financial disclosures we have provided specific commentary regarding certain balance sheet obligations. As of June 30, 2014 all of these balance sheet obligations were underfunded.

These obligations are:

- Deposit and Loan Program Trust

- Risk Insurance Trust

- Lay Employees’ Retirement Plan

- Priests’ retirement plans

Please find an update as of June 30, 2015 for each of these obligations below.

Deposit and Loan Program

Included in the financial statements for the Office for Financial Services are all assets and liabilities of the Archdiocese of Philadelphia Deposit and Loan Program Trust Fund (“Deposit and Loan Program Trust” or “D&L”). The Deposit and Loan Program Trust is a separate legal entity that provides a deposit and loan program for the benefit of parishes to assure continuation of the ecclesial goals of the Archdiocese and the parishes. If a parish deposits funds in the Deposit and Loan Program Trust, it receives a competitive interest rate. In turn, these funds are loaned to other parishes for construction and other projects.

During FY 2012, the Archdiocese executed a promissory note to the Deposit and Loan Program in the amount of $82 million, which represented the excess of deposits over assets as of of June 30, 2012. The promissory note is collateralized by specific pledged real estate assets which are documented in the note. As pledged properties are sold or monetized, net proceeds from these collateral transactions will be deposited into the Deposit and Loan Program Trust, in accordance with the provisions of the promissory note. In the event a transaction generates in excess of $20 million in net proceeds, the Archdiocese has discretion regarding alternative uses for the excess so long as remaining pledged assets are at least equal to the then outstanding principal amount owed.

As of June 30, 2015 the underfunded obligation (i.e. the excess of deposits over assets) in the Deposit and Loan Program Trust was as follows:

(in millions)

D&L Deposits $ 151.0 *

D&L Assets (excludes promissory note) 108.4

Excess of Deposits Over Assets $ 42.6

* includes approximately $158K in Deposit and Loan Program Trust Liabilities.

As of June 30, 2015 the balance outstanding on the promissory note was $44,950,000, which is greater than the underfunded obligation noted above. The following pledged properties are all under agreement of sale and, presently, we expect that each of these transactions should close in the timeframes noted below:

-Sproul Road property in Marple Township (Delaware County)

anticipated close before June 30, 2016

-Mary Immaculate Center property (Northampton County)

closed October 30, 2015

-Hilltown property (Montgomery County

anticipated close before June 30, 2016

-Manor Road property (Chester County)

anticipated close before December 31, 2017

Aggregate net proceeds in the $35-40 million range are expected (in the timeframe noted) for the transactions listed above ¾ thus resolving most of the remaining underfunded obligation in the Deposit and Loan Program Trust.

Risk Insurance Trust

The Risk Insurance Trust administers the risk management program of the Archdiocese. As part of the risk management program, levels of self-insurance risk are retained. As of June 30, 2015 insurance related assets exceeded insurance related liabilities, as follows:

(in millions)

|

Insurance Related Assets |

$ 52.9 |

|

Insurance Related Liabilities |

42.0 |

|

Excess of assets over liabilities |

$ 10.9 |

The Risk Insurance Trust is no longer an underfunded obligation.

Lay Employees’ Retirement Plan

The Lay Employees’ Retirement Plan (LERP) is considered a multiemployer plan for financial reporting purposes. As such, the assets and actuarially determined liabilities for this plan are not included in the OFS financial statements. The Archdiocese froze this defined benefit pension plan effective June 30, 2014.

While not a direct liability of OFS the amount by which the plan liability exceeds plan assets is a liability of the Archdiocese. The actuarially determined liability for this plan as of June 30, 2015 was not available as of the issue date of the OFS financial statements. A preliminary estimate of that liability is $639 million. It should be noted that our actuary will be using the updated mortality tables recently published by the Society of Actuaries to determine the liability. These tables reflect the most up-to-date estimates of life expectancy developed for the purpose of determining pension plan liabilities. The preliminary estimate also assumes the use of these new mortality tables.

When the estimated liability is compared to plan assets available for benefits as of June 30, 2015 (approximately $477 million), the plan’s shortfall is approximately $162 million.

Priests’ Retirement Plans

The Priests’ retirement plans are also considered multiemployer plans for financial reporting purposes. As such, the assets and actuarially determined liabilities for these plans are not included in the OFS financial statements.

While not a direct liability of OFS, the amount by which the plans’ liabilities exceeds assets is a liability of the Archdiocese. As of June 30, 2015 it is estimated that the Priests’ retirement plans’ liabilities (estimated at $107 million) exceeded assets (approximately $82 million) by approximately $25 million. It should be noted that our actuary will also be using the updated mortality tables to determine this liability and the preliminary estimate was prepared using those tables as well.

Looking Forward

The core operating deficit has improved each year since FY 2012’s deficit of $17.6 million. We continue to acknowledge that the core deficit needs to be eliminated completely in the very near future and we will continue to take steps to achieve at least a break-even result.

We have also made significant progress against our underfunded balance sheet obligations.

|

|

Underfunded Balance at |

|

|

|

June 30, 2012 |

June 30, 2015 |

|

Deposit and Loan Program |

$ 82.0 |

$ 42.6 |

|

Risk Insurance |

30.4 |

– |

|

Lay Employees’ Retirement Plan |

152.0 |

162.0 |

|

Priests’ retirement plans |

90.0 |

25.0 |

|

|

$ 354.4 |

$ 229.6 |

As noted earlier, we expect that most of the remaining underfunded obligation for the Deposit and Loan Program will be resolved by December 31, 2017 once the transactions for properties under agreement of sale are closed and the expected proceeds of $35-40 million are applied.

Going forward our remaining issues will be the underfunded pension obligations. The new mortality tables have impacted our pension liabilities but so too have investment returns and other factors. We expect that we will need to increase our funding rates, particularly for the LERP. We will also need to consider allocating proceeds from future real estate transactions to these obligations.

Additional Financial Statements for the Fiscal Year Ended June 30, 2015

The audited financial statements for OFS do not include financial results for the Office for Catholic Education, Catholic Healthcare Services, Catholic Social Services, Saint Charles Borromeo Seminary, Catholic Charities Appeal or the Heritage of Faith—Vision of Hope Capital Campaign, or the World Meeting of Families—Philadelphia 2015 as all are separate entities. Audited financial statements for these entities will be published in the coming weeks.

Additionally, none of the reports released by the Archdiocese will include financial statements for individual parishes. All parishes are independent and autonomous entities.

# # #

Editor’s Note:

Complete copies of the audited financial statements for the Office for Financial Services for the fiscal years ended June 30, 2015 and June 30, 2014 can be found at www.CatholicPhilly.com.

Endnotes

[i] The amounts represent the net gains resulting from the sales of several Archdiocesan properties.

[ii] The gain on the sale of the property known as “Villa St. Joseph by the Sea” in Ventnor, New Jersey was approximately $4.2 million. This amount was accounted for as a “Temporarily Restricted” gain and was reflected as such on the Statement of Activities and Changes in Net Assets for the year ended June 30, 2013. The proceeds from the sale were used for the benefit of Villa St. Joseph in Darby, Pennsylvania, a residence for retired Archdiocesan priests. Approximately $2.7 million of the gain was used for that purpose in FY 2013 and the balance was used in FY 2014. FY 2014 was also benefitted by approximately $ .7 million used to fund a commitment to the Independence Mission Schools.

[iii] The experience of the Risk Insurance and Welfare Benefits Trusts should be considered separately and treated as non-recurring.

[iv] OFS provides an “allowance for doubtful accounts” for outstanding loans that we do not expect to fully collect from parishes. This allowance, or “reserve,” is analyzed each year. In FY 2015 we determined that, because of positive collection experience, we could reduce this reserve by approximately $1.9 million. While this adjustment positively impacted our reported FY 2015 results, it is not an item – particularly when so significant – that we consider to be recurring.

[v] Non-recurring legal and professional fees is comprised of the following:

|

(in millions) |

FY 2015 |

FY 2014 |

|

Financial and legal costs incurred in connection with transactions |

$ .4 |

$ .9 |

|

Fees incurred for supplemental finance office staffing |

– |

.3 |

|

|

$ .4 |

$ 1.2 |