Human Resources Office

222 N. 17th St. Philadelphia, PA 19103

Phone: 215-587-3910

Email: [email protected]

Welcome to the Archdiocese of Philadelphia Employee Benefits Portal

Benefits Overview

If you are a lay employee of a parish, incorporated agency, or other participating institution of the Archdiocese of Philadelphia, you may be eligible for the benefits plans described below.

Before you enroll or change your elections, we encourage you to review the Benefits Guide and this website carefully. Learn what each plan offers. Take time to think about the future—whether that’s next year or 30 years from now.

Eligibility and Enrolling

This section reviews who is eligible and how to enroll.

WHO’S ELIGIBLE FOR COVERAGE

You may be eligible for the benefits highlighted in the Employee Benefits Guide if you are regularly scheduled to work at least 20 hours a week as a lay employee of a parish, incorporated agency, or other participating institution of the Archdiocese of Philadelphia. Benefit options and waiting periods vary by location. After you enroll, you may have to complete a waiting period before your Medical and Dental coverage begins. If you have questions about eligibility, contact the Benefit Coordinator at your location.

Note: You may change your elections during the annual enrollment period. During the year, you may make changes ONLY IF you have a Qualified Life Event as defined by IRS regulations. Dual Coverage—If you and your spouse both work for any Archdiocesan parish, agency, or other institution, only one of you may enroll your children. Also, you may not be covered as an Archdiocesan employee and as your spouse’s dependent at the same time.

COVERAGE FOR YOUR DEPENDENTS

If you enroll, your dependents also may be eligible for Medical, Dental, and Freestanding Vision coverage. Eligible dependents include your:

- spouse (marriage certificate must be made available upon request);

- unmarried dependent children under age 26 for Medical coverage; Dental coverage may continue up to age 19 (or 26 if a full-time student); and

- unmarried handicapped children over age 26 if covered before age 26 and incapable of self-support (for Dental, age 19).

To be covered under the Cigna Voluntary Life or Voluntary AD&D programs, your spouse must be under age 70 and your eligible dependent children must be at least 14 days of age and dependent upon you for support. Other limits may apply to Critical Illness or Voluntary Accident insurance.

Newborns/Newly-Adopted—You must enroll new dependent children within 30 days. If you do not submit an Enrollment Form within 30 days, the delivery will be covered but any other expenses for the child will not be covered. The 30-day period starts at birth or the date you assume legal obligation for support in anticipation of adoption (whichever applies). If you do not submit an Enrollment Form within 30 days, you will have to wait until the next annual enrollment period to enroll the child.

COST OF COVERAGE

You may be asked to contribute toward the cost of Medical coverage for you and your dependents. Your contributions, if any, are deducted before taxes are deducted (pre-tax) — that means tax savings for you. The required contribution varies by location, and you will be given information about your share of the cost when you enroll.

If you enroll for Dental, Freestanding Vision, or Voluntary Life/AD&D Insurance (Cigna) coverage for yourself, you pay the full cost on a pre-tax basis. If you enroll for Voluntary Whole Life Insurance, Critical Illness, Voluntary Accident, or Short-Term Disability (STD) coverage, you pay the full cost on a post-tax basis.

HOW TO ENROLL OR CHANGE YOUR ELECTIONS

You enroll for benefits when you are first eligible. If you do not enroll within 30 days of becoming eligible, you must wait until the annual enrollment period. If you elect Voluntary Life or Voluntary AD&D coverage more than 30 days after becoming eligible, proof of good health will be required, even at annual enrollment periods. If you are waiving medical coverage during annual enrollment, you MUST return an enrollment form to certify that you have other medical coverage.

Changing Your Elections

Under IRS rules, benefits that you pay for with pre-tax contributions (Medical, Dental, Freestanding Vision, Voluntary Life Insurance coverage for you, and Voluntary AD&D) stay in effect for the full Plan Year (7/1-6/30), unless you have a change in status (Qualified Life Event) and request the change within 30 days (60 days for CHIP).

CHANGES IN STATUS INCLUDE:

- a change in your marital status (such as marriage, divorce, legal separation, or annulment);

- a change in your dependents for tax purposes (such as birth, legal adoption of your child, placement of a child with you for adoption, or death of a dependent);

- certain changes in employment status that affect benefits eligibility for you, your spouse, or your child(ren) (such as, termination of employment, start or return from an unpaid leave, a change in worksite, change between full-time and part-time work, or a decrease or increase in hours);

- your child no longer meets the eligibility requirements;

- entitlement to Medicare or Medicaid (applies only to the person entitled to Medicare or Medicaid);

- a change to comply with a state domestic relations order pertaining to coverage of your dependent child;

- eligibility for COBRA coverage for you or your dependent spouse or child;

- a change in place of residence;

- a significant increase in the cost of coverage or a significant reduction in the benefit coverage under your or your spouse’s health care plan;

- the addition, elimination, or significant curtailment of coverage;

- change in your spouse’s or child’s coverage during another employer’s annual enrollment period when the other plan has a different period of coverage; and

- a loss of coverage from a governmental or educational institution program.

LOSS OF MEDICAID OR CHIP COVERAGE: If you decline enrollment for yourself or for an eligible dependent (including your spouse) while Medicaid coverage or coverage under a state children’s health insurance program (CHIP or SCHIP) is in effect, you may be able to enroll yourself and your dependents for Medical coverage if you or your dependents lose eligibility for that other coverage. However, you must request enrollment within 60 days after your or your dependents’ coverage ends under Medicaid or a state children’s health insurance program.

When Dependent Coverage Ends

Health plan coverage for children will end on the last day of the month in which the child reaches age 26 (for Dental, age 19 or age 23 for full-time students).

Extended Medical Coverage—You may enroll your adult child for individual coverage and extend his/her medical coverage from age 26 until age 30 if your child is: unmarried and under age 30 with no dependents of his or her own; a Pennsylvania resident (may be a full-time college student elsewhere); and not enrolled in any other health coverage, whether individual, group, or government provided, including Medicare.

If you choose this option, your child will be covered as an individual, not as your dependent. This will affect your total cost. You will continue to pay your share of the cost for your coverage plus the full cost (no employer contribution) for your child’s coverage. You will need to complete a separate enrollment form for your adult child. See your Benefit Coordinator for more information. There is no requirement that your child be a tax dependent. This extended coverage does not apply to Dental or Vision coverage.

Other Important Information

ANNUAL REQUIRED NOTICES

CHOOSING YOUR PCP—PROVIDER CHOICE NOTICE

The Keystone POS and Keystone HMO options allow (POS) or require (HMO) you to designate a Primary Care Provider (PCP). You have the right to designate any PCP who participates in the Keystone POS/HMO network and is available to accept you or your family members. Before you complete your enrollment in the Keystone POS or HMO option, you will choose your PCP. Each member of your family can choose a different PCP, and you may choose a pediatrician for your children. You may change your PCP at any time by calling the Member Services number on your ID card or online at www.ibx.com/archdiocese.

Designated Facilities—PCPs are required to choose one radiology, physical therapy, occupational therapy, and laboratory provider where they will send all their Keystone members. You can view the sites selected by your PCP at www.ibx.com/archdiocese.

You do not need prior authorization from Keystone Health Plan East or from any other person (including a PCP) to obtain access to obstetrical or gynecological care from a Keystone POS/HMO network healthcare professional who specializes in obstetrics or gynecology. However, that healthcare professional may be required to comply with certain procedures, including obtaining prior authorization for certain services, following a preapproved treatment plan, or procedures for making referrals.

Your local Benefit Coordinator can give you more information about how you select a PCP. A Keystone POS/HMO network directory that includes PCPs and physicians who specialize in obstetrics or gynecology is available from Member Services. You can also access the directory online at www.ibx.com/archdiocese or ibxpress.com.

IMPORTANT— FOR THE KEYSTONE POS OPTION: Benefits will be paid at the lower Self-Referred level if you do not choose a PCP. Benefits also will be paid at the lower level if you use a provider without a PCP referral, even a provider in the Keystone POS/HMO network.

WOMEN’S HEALTH AND CANCER RIGHTS ACT

The Women’s Health and Cancer Rights Act requires group health plans to provide coverage for these services to any person receiving benefits in connection with a mastectomy:

- Reconstruction of the breast on which the mastectomy has been performed,

- Surgery and reconstruction of the other breast to produce a symmetrical appearance,

- Prostheses and the treatment of physical complications for all stages of a mastectomy, including lymphedemas (swelling associated with the removal of lymph nodes).

If you receive benefits from the Medical Plan for a mastectomy and elect to have reconstructive surgery, then the Medical Plan must provide coverage in a manner determined in consultation with the attending physician and the patient. The Medical Plan’s benefit for breast reconstruction and related services will be the same as the benefit that applies to other services covered by the Medical Plan. While the law requires that we provide this notice, it is important to note that the Company’s Medical Plan already covers these expenses.

CHIP NOTICE

Premium Assistance Under Medicaid and Children’s Health Insurance Program (CHIP)

If you or your children are eligible for Medicaid or CHIP and you’re eligible for health coverage from your employer, your state may have a premium assistance program that can help pay for coverage, using funds from their Medicaid or CHIP programs. If you or your children aren’t eligible for Medicaid or CHIP, you won’t be eligible for these premium assistance programs but you may be able to buy individual insurance coverage through the Health Insurance Marketplace. For more information, visit www.healthcare.gov.

If you or your dependents are already enrolled in Medicaid or CHIP and you live in a State listed below, you can contact your State Medicaid or CHIP office to find out if premium assistance is available. If you or your dependents are NOT currently enrolled in Medicaid or CHIP, and you think you or any of your dependents might be eligible for either of these programs, contact your State Medicaid or CHIP office or dial 1.877.KIDS NOW or www.insurekidsnow.gov to find out how to apply. If you qualify, ask your State if it has a program that might help you pay the premiums for an employer sponsored plan. If you or your dependents are eligible for premium assistance under Medicaid or CHIP, as well as eligible under your employer plan, your employer must allow you to enroll in your employer plan if you aren’t already enrolled. This is called a “special enrollment” opportunity, and you must request coverage within 60 days of being determined eligible for premium assistance. If you have questions about enrolling in your employer plan, contact the Department of Labor at www.askebsa. dol.gov or call 1.866.444.EBSA (3272).

If you live in one of the following States, you may be eligible for assistance paying your employer health plan premiums. The following list of States is current as of January 31. Contact your State for more information on eligibility.

PENNSYLVANIA (Medicaid)

- Website: https://www.dhs.pa.gov/Services/Assistance/Pages/HIPPProgram.aspx

- Phone: 1.800.692.7462

NEW JERSEY (Medicaid and CHIP)

- Medicaid: http://www.state.nj.us/humanservices/dmahs/clients/medicaid/

- Medicaid Phone: 1.609.631.2392

- CHIP Website: https://www.dhs.pa.gov/CHIP/Pages/CHIP.aspx

- CHIP Phone: 1.800.986.KIDS (5437)

NEW YORK (Medicaid)

- Website: http://www.nyhealth.gov/health_care/medicaid/

- Phone: 1.800.541.2831

To see if any other states have added a premium assistance program since January 31, or for more information on special enrollment rights, contact either:

U.S. DEPT. OF LABOR

Employee Benefits Security Administration

www.dol.gov/ebsa

1.866.444.EBSA (3272)

U.S. DEPT. OF HEALTH & HUMAN SERVICES

Centers for Medicare & Medicaid Services

www.cms.hhs.gov

1.877.267.2323, Menu Option 4, Ext. 61565

Health Benefits

If you are a lay employee of a parish, incorporated agency, or other participating institution of the Archdiocese of Philadelphia, you may be eligible for the medical, vision and dental benefits plans. Before you enroll or change your elections, we encourage you to review the information on the available health benefits plans and learn what each plan offers.

Enrollment Forms and Information

| Benefits Guide | Benefits Overview Presentation |

| Enrollment Form | |

| Freestanding Vision Plan Enrollment Form | HealthEquity Website |

| HealthEquity Member Guide |

Medical & Vision

Your local Benefit Coordinator will give you information about the medical and vision plan options available to you and your cost for coverage. All of the options are provided through Independence Blue Cross (IBC) or Keystone Health Plan East. If you have specific questions, contact Member Services at 1.800.ASK.BLUE (275.2583).

The Medical Plan options offered by your employer may include:

- Personal Choice® HDHP is a high-deductible health plan (HDHP) – a type of plan that has a higher deductible than more traditional plans – and allows you and your employer to contribute to a tax-advantaged Health Savings Account (HSA) if you are eligible. For this option, preventive care is covered at 100% with no deductible. All other expenses, including prescriptions, are subject to the deductible. Read the explanation here and see all details here

- Personal Choice® PPO and Personal Choice HDHP are “Preferred Provider Organization” (PPO) plans. That simply means you receive a higher level of benefits if you use providers in the IBC Personal Choice network (called staying “In-Network”). You may use other providers (called going “Out-of-Network”). If you do, the Plan’s benefits are lower, you must file claim forms, some services may not be covered, and you may be responsible for charges above the IBC Plan allowance. Read more here

- Keystone POS is a “Point of Service” plan, which is a cross between a PPO and an HMO. If you enroll, you should select a primary care physician (PCP) from the Keystone POS/HMO network. Generally, to receive the highest level of benefits, your PCP must provide your care or give you a referral. This is called Referred care. If you use other providers without a referral from your PCP, you will receive a reduced level of benefits. This is called Self-Referred care—you must file claims, the Plan pays less, some services may not be covered, and you may be responsible for charges above the Keystone Plan allowance. Read more here

- Keystone Health Plan East HMO is a Health Maintenance Organization. To receive benefits, you must choose a PCP in the Keystone POS/HMO network who will provide your care or refer you to other Keystone HMO providers. Unlike the other options, all services must be provided by Keystone HMO network providers. If you seek services on your own, without receiving a referral from your PCP, the cost of services will not be covered by the Plan (except for true emergency care). Before you complete your Keystone POS or Keystone HMO enrollment, you will choose a PCP for you and each covered family member. You may change your PCP at any time by calling Member Services or online at ibxpress.com. Read more here

Independence Blue Cross Contact Information:

- Medical Plans (HDHP, PPO, POS, and HMO):

- 1.800.275.BLUE (2583)

- Member Services, provider directory, pre-certification, claims, Telemedicine, coaching :

- www.ibx.com/archdiocese

- Ibxpress.com (requires you to register)

More information about the plan options:

(Below each plan are documents called Summary of Benefits Coverage that can help you compare plans both within and outside of the Archdiocese of Philadelphia)

- Telemedicine

- Personal Choice HDHP/Vision Plan Summary

- Personal Choice PPO Plan Summary

- Keystone POS/Vision Plan Summary

- Keystone HMO/Vision Plan Summary

- Freestanding Vision Plan

VISION COVERAGE

Three of the Medical options include Davis Vision coverage. The Keystone POS and Keystone HMO plans include the $35 Vision program that provides benefits for eyeglasses or contact lenses. The Personal Choice HDHP plan includes the $75 Vision program that provides benefits for exams and eyeglasses or contact lenses. When you use Davis Vision providers, you receive higher benefits.

The names ($35 or $75) refer to the reimbursement for certain services. If you elect the Personal Choice PPO or waive coverage, you may enroll in the Freestanding Vision Plan (this is the $75 Vision program). You pay the full cost (separate enrollment form required). See the Plan Summary Chart for more.

Prescription Plans and Other Information

TELEMEDICINE (Teladoc Health)

Teladoc Health (Teladoc) is a convenient option when it’s not possible to visit your doctor’s office, retail clinic, or urgent care center. Plus, it’s more cost-effective than visiting the ER for an illness that’s not an emergency. You can see a board-certified doctor by secure video, phone, or mobile app who can treat non-emergency conditions such as allergies, asthma, cold/flu, ear or respiratory infections, and nausea or vomiting. Medication can be prescribed if indicated. Activate your account now at TeladocHealth.com so you will be ready to chat with a doctor when you need one.

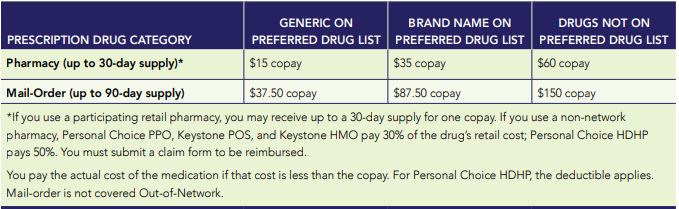

PRESCRIPTION DRUG COVERAGE

When you elect any of the Medical options, you automatically receive prescription drug coverage administered by FutureScripts®. The Medical Plan uses a Preferred Drug List (called a formulary), which encourages the use of the most clinically-effective and cost-effective medications. Contact Member Services for a copy of the current Preferred Drug List.

If your doctor prescribes a drug that is not on the Preferred Drug List, ask if another drug, such as a generic equivalent or therapeutic alternative, can be used to treat your condition.

Health Savings Account (HSA)

The Personal Choice HDHP medical option comes with a Health Savings Account (HSA), a tax-advantaged “piggy bank” that lets you save for current and future healthcare expenses on a tax-free basis. This section reviews key facts about how the HSA works. You also can watch presentations on the Benefits Gateway or on the HealthEquity website (healthequity.com).

HSA CONTRIBUTIONS

Employer Contributions—To help you meet the deductible, your employer will contribute $875 (effective July 1, 2024 and prorated if you participate for less than the full plan year). Your employer will contribute even if you don’t—and their contribution may be more than $875 if they share the cost of family medical coverage.

Your Contributions—You may add pre-tax contributions to your HSA through payroll deductions. The IRS sets a maximum contribution for each calendar year. See the Benefits Guide for the current contribution limits or check the Health Equity website. Note: Tax penalties apply if you contribute too much.

Eligibility for HSA Contributions—You and your employer can contribute to an HSA only if your only medical coverage is a high deductible health plan (HDHP), such as Personal Choice HDHP, you are NOT enrolled in any part of Medicaid, Medicare, or VA benefits, you are a U.S. citizen or resident alien at least age 18 with a valid U.S. address and Social Security number, and you are not claimed as a dependent on anyone else’s tax return.

Eligible Expenses— You may use your HSA for eligible health expenses not covered by another source. The IRS determines what expenses are eligible. For details, see IRS Publication 502 at irs.gov.

MANAGING YOUR HSA

The HSA is administered by HealthEquity. You manage your HSA through the website at healthequity.com. The website includes videos, calculators, FAQs, and narrated presentations about how HSAs work and how to use your account. For specific tax questions, speak with a tax advisor. The HSA is YOUR account. YOU are responsible for ensuring that you are eligible for HSA contributions, that contributions do not exceed the IRS maximum, and that you use the account only for qualified medical expenses. Be sure to keep your receipts.

| TOP 5 HSA ADVANTAGES |

| 1. Triple Tax Advantage— Contributions, earnings, and qualified distributions are tax free (state tax treatment varies) provided IRS regulations are followed. |

| 2. Free Money— Your employer will contribute (see Employer Contributions). You can add pre-tax contributions. |

| 3. Roll Over— Unused contributions roll over each year and grow with new contributions and earnings. |

| 4. It’s Yours— The HSA is your account—you take it with you wherever you go. |

| 5. Use It or Save It— You can use your HSA for eligible expenses today for you, your spouse, or your eligible dependents—or save it for future expenses. |

IBXPress

GET THE MOST FROM YOUR MEDICAL COVERAGE WITH ibxpress.com

When you register for ibxpress.com, you will have quick, convenient, and secure access to your benefits information, health information, wellness resources and more. With up-to-date claims and coverage information, lifestyle improvement programs, and relevant health information, ibxpress.com makes it easy to manage your benefits. And because ibxpress.com uses the strongest encryption methods available, you can rest assured that your personal information is secure.

- Begin your Journey—Register or log in to ibxpress.com or the IBX mobile app, then:

- Complete the Well-being Profile—This easy-to-use health profile takes just 15 minutes to complete. Based on your answers, you’ll get a personalized report with recommended focus areas.

- Start a Program—Choose from hundreds of programs to create a personalized Action Plan and daily activities to help you meet your goals.

- Develop Your Action Plan—Your daily Action Plan will display any current programs you are participating in, as well as helpful articles, videos, and healthy recipes that will help you on your well-being journey.

- Track Your Activity—It’s easy to track your progress and daily activity. If you use other apps or devices (like FitBit®) to track your health and well-being, you can sync them to ibxpress.com.

PRE-CERTIFICATION REQUIREMENTS

Pre-certification review is designed to ensure that all the services you receive are medically necessary, appropriate, and cost-effective. Generally, when you receive In-Network PPO care, or when your PCP provides or coordinates your care, your doctor/PCP or the hospital will handle any pre-certification for you. However, if you receive Out-of-Network or Self-Referred care—or you are out of your plan’s service area—YOU may be required to call 1.800.275.2583 for pre-certification. For the Personal Choice HDHP and Personal Choice PPO plans, this is true even if you use a provider or facility that participates in the BlueCard PPO program.

If you do not get pre-certification when required, benefits may be reduced or not paid at all. The pre-certification requirements for each option vary. See the Plan Summary charts and read the carrier booklet for your option for details. Contact Member Services at the number shown on your ID card if you have questions.

URGENT OR EMERGENCY CARE

When you have a life-threatening medical situation, seek treatment at the nearest emergency room. For other issues that require attention, such as strains or sprains, fevers, earaches, and sore throats, consider calling your doctor or using the Telemedicine service described below. Or, go to the nearest In-Network urgent care center.

ADDITIONAL DISCOUNTS – BLUE 365

Blue365 offers discounts for fitness centers, nutrition and weight management programs, laser vision correction, parent and senior care, hearing aids, and fitness apparel. To take advantage of Blue365, just access the Blue365 website through ibxpress.com. These exclusive discounts from leading, national brands are included at no cost to you.

Dental Plans

Your Dental Plan election is separate from your Medical Plan election. Depending on your location, you may have the option to choose one of four plans. The Dental Plan options include two dental maintenance organization plans (the Concordia Plus DHMO or the Aetna Dental DMO) and two preferred provider organization plans (the Concordia Flex PPO or the Aetna Dental PPO). If you elect coverage, you pay the full cost on a before-tax basis.

UNITED CONCORDIA OPTIONS

- Concordia Plus DHMO—Each covered person chooses a Primary Dental Office that provides or arranges all eligible dental care. This option pays 100% for periodic exams, cleanings, and fluoride treatments. Reduced copayments apply to more complex procedures. See More Here

- Concordia Flex PPO—This option pays the same percentage for In-Network and Out-of-Network services. However, if you use dentists in the extensive Elite Plus network, you will benefit from the lower negotiated rates, and you cannot be billed for charges above that amount. See More Here

Contact Info: CONCORDIA PLUS DHMO OR CONCORDIA FLEX PPO

DMO: 1.866.357.3304

PPO: Elite Plus network 1.800.332.0366

AETNA OPTIONS

- Dental DMO—Benefits are paid only if your primary care dentist provides your care or gives you a referral to another Aetna network provider for specialized care. You may go directly to an Aetna network orthodontist without a referral from the primary care dentist. See More Here

- Dental PPO—You may use the dentist of your choice. However, when you use a network provider, you get the advantage of the discount offered under the Plan, and your out-of-pocket costs are lower. When you use a non-network dentist, you pay a greater share of the cost, and the Plan discount is not available. See More Here

Contact Info: AETNA DMO OR PPO (PPO II network) – 1.877.238.6200

Wellness

Every day, you contribute to the continued success of the mission of the Church. Your well-being is important. The Archdiocese of Philadelphia offers programs to assist you in your journey towards healthier living:

Employee Assistance Program (EAP)

The Optum Employee Assistance Program (EAP) offers you and your dependents free confidential counseling to help with a range of issues, such as anxiety, stress, parenting or relationship concerns, or grief.

- Visit Optum EAP online (You can visit a section specifically for the Archdiocese by clicking the “Organization and employer resources” box and then using the access code “Archphilly”)

- Support and resources for you and your family at LiveAndWorkWell (select “Browse as a guest” and use access code “Archphilly”)

- Watch an introduction to the Optum EAP

- Watch the overview of EAP and WorkLife services to see what’s included

- See the flyer for an overview

My Health Awareness

Income Protection Benefits

Disability Income Protection

Disability coverage protects your income when illness or injury prevents you from working. There are two types of coverage: Short-Term Disability (STD), if available at your location and Long-Term Disability (LTD). You also have the option to buy Critical Illness or Accident insurance.

SHORT-TERM DISABILITY (STD) COVERAGE

Short-Term Disability (STD) coverage provided by Unum may be available for active employees between the ages of 17 and 69. Your Benefit Coordinator can tell you if this coverage is available at your location. Three coverage options may be available:

| Option 1 | Option 2 | Option 3 |

| Up to $400 per month | Replaces up to 30% of monthly income | Replaces up to 60% of monthly income |

| Maximum benefit of $3,000 per month | ||

| If you are disabled for at least three months, you may be eligible for Long-Term Disability (LTD) benefits. |

COST OF COVERAGE: If you enroll for STD coverage, you pay the full cost with after-tax dollars. If you become disabled, the benefits you receive are not taxable. STD coverage is portable—that means you can continue coverage if you leave your employer by paying premiums directly to Unum.

For details, see the information in the Voluntary Protection Benefits section of this page. To enroll, call TriBen at 1.888.264.2147, Option 8.

If you purchase this coverage and Unum determines that you have a qualifying illness or injury, benefits may begin after 14 days of continuous disability. This benefit may be reduced by income you receive from other sources, and benefits may not be provided if you have a pre-existing condition. Benefits will continue for the duration of your disability for up to a maximum of three months.

LONG-TERM DISABILITY (LTD) COVERAGE

Your employer pays the full cost of this coverage that begins to pay benefits after 90 days of continuous disability. New York Life Group Benefit Solutions can provide a booklet that explains the plan in detail. While you are totally disabled, the Plan will replace up to 60% of your monthly earnings up to $9,200 per month. This benefit is taxable. LTD benefits are reduced by income you receive from other sources, such as Social Security or Workers’ Compensation. To qualify for benefits, you must be considered disabled. For the first three years of disability, you must be under the care of a licensed physician and completely unable to do your regular job. After three years, you must be unable to perform the duties of any job for which you are, or could become, qualified for by education, experience, or training. Benefits may not be available if you have a pre-existing condition. Benefits will be paid while you remain disabled as determined by the insurance carrier. Benefits will end if you recover, reach the maximum benefit and or die, whichever occurs first.

Critical Illness / Accident Insurance

Depending on your location, you may have the option to elect additional voluntary benefits. If you enroll, you pay the full cost. Two additional voluntary coverages may be available depending on your location:

- Aflac Critical Illness Insurance—This coverage provides a lump-sum payment for specified catastrophic conditions, and the benefit can be used for medical and nonmedical expenses. The Plan does not cover certain types of accidents (such as injury while learning how to fly a plane). Proof of good health may be required. Children are automatically covered at 50% of your coverage amount at no additional cost.

- Unum Accident Insurance—This coverage is designed to help you meet out-of-pocket expenses and extra bills that can follow even ordinary accidents. Coverage is available for employees, spouses and children, and proof of good health is not required. If you enroll, the benefits are tax-free, and the coverage is portable.

For more information, see Voluntary Protection Benefits section of this page To enroll, call TriBen at 1.888.264.2147, Option 8.

Voluntary Life / AD&D Insurance

If available at your location, you may elect term life insurance, AD&D insurance, or whole life insurance. If you elect this coverage, you pay the full cost.

TERM LIFE AND VOLUNTARY LIFE/AD&D INSURANCE

As explained below, you may be eligible for employer-provided term life insurance and have the option to buy additional life insurance and/or AD&D (accident) insurance. To elect this coverage and name your beneficiary, use the Enrollment Form on the Forms and Documents section below. Be sure to update your beneficiary information for life changes, such as marriage or a new child. For details, see the Life/ AD&D brochure on this page or call New York Life Group Benefit Solutions at 1.800.362.4462.

EMPLOYER PAID LIFE INSURANCE BENEFIT

If you die while you are actively employed and you were regularly scheduled to work at least 20 hours a week, your designated beneficiary will receive a $15,000 Life Insurance benefit. This $15,000 Life Insurance benefit is provided at no cost to you and is in addition to any Voluntary Life Insurance benefit to which your beneficiary may be entitled.

TERM LIFE INSURANCE COVERAGE FOR YOU

This coverage may pay benefits if you die while you are enrolled and eligible for the plan (the “term” of the coverage). If available at your location, you may buy coverage for yourself in $10,000 increments up to $500,000. If you elect this coverage, you pay the full cost on a pre-tax basis. The cost is based on your age as of July 1 and the amount of coverage. Proof of good health is required if:

- You elect coverage more than 31 days after you first become eligible;

- You elect Voluntary Life Insurance for yourself and the amount equals the lesser of $200,000 or three times your annual salary rounded to the next higher $10,000; or

- You want to increase your coverage. If proof of good health is required, the coverage amount subject to medical evidence will take effect only after the insurance carrier approves. Note: Benefits will not be paid if loss of life is the result of suicide within the first two years of coverage.

VOLUNTARY AD&D INSURANCE

If available at your location, you may buy Voluntary AD&D coverage for yourself from $10,000 to $300,000. If you elect this coverage, you pay the full cost on a pre-tax basis. Your cost is based on a fixed rate for each $10,000 of coverage. If you insure your family, the cost is slightly higher.

If you die in a covered accident, your beneficiary receives 100% of the coverage amount. All or part of the benefit is paid for certain serious injuries that occur within one year of a covered accident.

VOLUNTARY WHOLE LIFE INSURANCE

To create the life insurance that’s best for your needs, you may have the opportunity to elect Whole Life Insurance that’s portable and builds a cash value. This coverage is provided through New York Life Insurance Company. If available at your location, you may buy Voluntary Whole Life Insurance coverage from $5,000 up to $100,000 if you are a full-time employee under age 70. Proof of good health is NOT required if you enroll when you are first eligible. If you elect this coverage, you pay the full cost on a post-tax basis. The cost is based on your age as of July 1 and the amount of coverage. Here are key facts to know about this coverage:

- This is whole life insurance that pays benefits to your beneficiaries if you die AND builds a cash value.

- Your premium will never increase and you may keep your policy if you leave the Archdiocese or retire.

- The cash value builds tax-deferred. You may borrow against the cash value for various needs, such as children’s college, paying off a mortgage, or supplementing retirement income.

- Loans against your policy accrue interest and decrease the death benefit and cash value.

- Coverage also is available for your spouse, children, and grandchildren.

For details and to enroll, contact Legacy Benefits at 215.441.6554 or 609.412.4165.

Retirement

403(b) Retirement Plan – Plan to Retire Well

Our support for you

You may have concerns about the economy’s reaction to the coronavirus and how it affects your plan account at Vanguard. Rest assured that our operations continue as usual and that, if you need to reach us, our Participant Services associates continue to be available to take your calls.

Although we’re doing our best to serve each of our participants in a timely manner, wait times are longer because our call volumes are higher than normal. You may find it more convenient to use our online resources instead.

- Visit our market volatility page for our news and views. We’re staying on top of the latest information and relaying crucial updates to you.

- Log on to vanguard.com/retirementplans for secure online support. Our website is available 24/7. You can view key information about your plan account and complete most transactions with a few simple clicks.

If you do need to talk to us, our associates are here to help. As you can imagine, we greatly appreciate your support and understanding during this difficult time. We hope you will stay safe as we work through this challenging situation. And when you need support, know we’ll be here for you—every step of the way.

This section provides a brief overview of the 403(b) Retirement Plan. For details, see the Summary Plan Description

Employer Contribution – Even if you don’t contribute, your employer may make a discretionary contribution if you complete 1,000 hours of service in a calendar year. The current contribution is 4.5% of your eligible pay, and the amount will be announced each year. You become vested (own) this contribution when you complete one year of service.

Your Contributions – If you are a full-time or part-time employee, you can increase your retirement income by adding your own pre-tax or post-tax savings (in a Roth account). You can choose one method or both. Your contribution comes out of your pay before you miss it or spend it. When you enroll, you can choose to contribute any percentage of your pay, up to the annual IRS limit ($23,000 for 2024). Your 403(b) account is yours. You take your account with you, even if your employment ends before you retire.

Vanguard Administers the Plan – You have a range of investment options, secure 24/7 access to your account, planning tools, and service from experienced professionals. Keep in mind that the value of your investment will fluctuate and you may gain or lose money.

ENROLLING IS EASY! – To contribute and manage your account, you need to enroll. Visit ENROLL NOW and enter your Social Security number, zip code, birth date, and Plan No. 094572. Click Continue and follow the easy steps from there.

Discounts and Offers

Discount Programs

The following discount programs are available:

- Health Improvement— HUSK gives you the flexibility and convenience to book workout classes and sessions based on activity preference, budget, fitness goals, and location.

- Entertainment—Plum Benefits offers discounts on movie tickets, theme parks, hotels, plays, and sporting events. If you’re planning a vacation to Orlando, take advantage of Orlando Employee discounts.

- Wireless Service—You can receive discounted rates for AT&T or Verizon wireless services. Show your employee ID badge or your pay stub at the store.

- Tuition Savings—The Villanova University School of Business offers 50% tuition savings for an MS in Church Management. The Widener University Collegiate Partnership program offers 10% tuition savings for a Master of Business Administration (MBA), a Masters in Social Work (MSW), or a Registered Nurse Bachelor of Science in Nursing (RN-BSN). The University of Delaware Collegiate Partnership gives you 10% off tuition of participating online programs. Tuition Reimbursement is available, as funds allow, to eligible CHCS employees who wish to attend college or enroll in approved education courses that directly relate to the mission of CHCS. In order to obtain Tuition Reimbursement, you must meet certain eligibility requirements. Contact us for more information or download the Tuition Reimbursement form.

- Get help buying and selling a home with the Smartmove program.

- Pet Insurance—My Pet Protection® from Nationwide® helps you provide your pets by reimbursing you for vet bills. You can get cash back for accidents, illnesses, hereditary conditions and more. You’re free to use any vet and will get additional benefits for emergency boarding, lost pet advertising and more. Get a fast, no-obligation quote today at PetsNationwide.com or by calling 877-738-7874.

See the Contact Information sheet for full information.

American Heritage Credit Union

The Archdiocese partners with American Heritage Credit Union to offer employees membership in a credit union that is ranked one of the best in Pennsylvania. The credit union has more than 37 branch locations across Philadelphia, Bucks, Montgomery, Delaware and Camden Counties.

American Heritage Credit Union offers guidance and solutions for your current financial situation and long-term goals. From free checking accounts to mortgages, auto loans, and personalized investment strategies, this full-service credit union has the resources you need for every step of your financial journey. For more information or to become a member, contact

Joseph Littman, Partnership Account Manager

215-370-7088 • [email protected]

You can learn more at AmericanHeritageCU.org/Archdiocese.

Explore and discover the best ways to master your financial future in the Education section of our website! From the Learning Center and our financial wellness app, Zogo, to a list of upcoming financial wellness workshops, you can enjoy the same quality resources from across our site, now housed in one convenient location:

https://americanheritagecu.org/learn

Learn about what American Heritage Credit Union is here

American Heritage offers a variety of checking accounts and digital services to meet your needs and fit your lifestyle. Earn an extra $200** by setting up a direct deposit of $500 or more per month and use your debit card 25 times or more within the first three months.

Choose the account that’s right for you: totally-free checking or one of our premium checking accounts with high-yielding rates. All checking accounts include free debit cards and surcharge-free access to over 30,000 ATMs!

All Forms and Documents

Benefits Information

- Enrollment Form

- Freestanding Vision Plan Enrollment Form

- Benefits Guide

- HealthEquity Website

- Paid Parental Leave

Medical/Vision Benefits (Options vary by location)

- Telemedicine

- Personal Choice HDHP/Vision Plan Summary

- Personal Choice PPO Plan Summary

- Keystone POS/Vision Plan Summary

- Keystone HMO/Vision Plan Summary

- IBC More Information/Discounts

- Freestanding Vision Plan Chart

Dental Benefits (Options vary by location)

Voluntary Protection Benefits (Options vary by location)

- Voluntary Term Life/AD&D Insurance Rate Sheet

- New York Whole Life Insurance

- Short-Term Disability (STD)

- Critical Illness

- Voluntary Accident

Other Benefits (Options vary by location)

- Comparison Insurance Agency – NEW!

- Employee Assistance Program (EAP)

- Plum Benefits

- American Heritage Credit Union

- Orlando Employee Discounts

- Widener University Partnership (& employee verification form)

- Villanova University Collegiate Partnership

- Immaculata University MA Info Session: a MA in Educational Leadership offered by Immaculata University will be offered at a significant reduction in costs.

- Verizon Discount

- AT&T Discount

- Book workout classes with the HUSK Movement app

- Six Flags Discount Tickets

403(b) Retirement Plan

- Vanguard

- Vanguard Plan Highlights

- 403(b) Plan Highlights

- 403(b) Retirement Plan SPD

- 403(b) Enrollment Guide

- Beneficiary Flyer

- Vanguard investment options

- About investment rates

- Online Education program

- Pre-tax or after-tax contributions

- About Target-Date investments

- A guide to your retirement timeline

- Vanguard website and mobile app information

Legal Notices / Summary Plan Descriptions

- Lay Employees Retirement Plan SPD

- SBC_July 2024 AmeriHealth POS Custom Flex Arch Parishes_Agencies Package

- SBC_July 2024 Keystone POS Custom Flex Arch Parishes_Agencies Package

- SBC_July 2024 Personal Choice Custom Flex Arch Parishes_Agencies Package

- SBC_July 2024 AmeriHealth HMO Custom Flex Arch Parishes_Agencies Package

- SBC_July 2024 PPO Base Custom Flex Trustees Priests Package

- SBC_July 2024 PPO Plus Custom Flex Trustees Priests Package

- SBC_July 2024 Keystone HMO Custom Flex Arch Parishes_Agencies Package

- SBC_July 2024 Keystone HMO Custom Flex Trustees Priests Package

- SBC_July 2024 Personal Choice HDHP Custom Flex Arch Parishes_Agencies Package

- BH_July 2024 AmeriHealth POS_RX_Vision

- BH_July 2024 AmeriHealth HMO_RX_Vision

- BH_July 2024 HDHP_RX_Vision

- BH_July 2024 Keystone POS_RX_Vision

- BH_July 2024 Keystone HMO_RX_Vision

- BH_July 2024 Personal Choice PPO_RX

- 2024 PA CHIP Notice

Staff

HUMAN RESOURCES

Phone: 215-587-3910

Email: [email protected]

RECEPTIONIST:

Karen Harrison

DIRECTOR:

Maureen Gallagher, M.S.

ASSISTANT DIRECTOR:

Jay Wieckowski, M.S. SHRM-SCP

BENEFITS COORDINATOR:

Doreen Snyder

TALENT ACQUISITION SPECIALIST:

Soryfel Cruz

HUMAN RESOURCES MANAGERS:

James Goldstein, SHRM-SCP

Jessa Lodovici, SHRM-CP