Reports illustrate a surplus in the core operating result and an improvement of over $270 million against underfunded balance sheet obligations; projections include the expectation of a break-even or better result for the operating budget in the fiscal year ending June 30, 2019.

Contextual Background

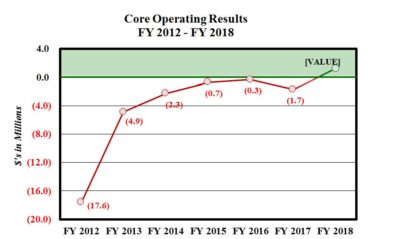

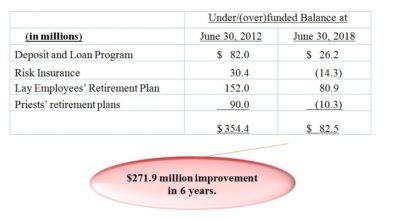

For the fiscal year ended June 30, 2012, the Archdiocese of Philadelphia disclosed a core operating deficit of $17.6 million as well as underfunded balance sheet obligations totaling $354.4 million.

Since that time, results have improved significantly as reflected in the graph and the table presented below. The core operating result for the fiscal year ended June 30, 2018 was a surplus of $1.3 million. This surplus is slightly better than our expectation of a break-even result. We also expect to achieve a break even or better core operating result for the fiscal year ended June 30, 2019.

In addition, as of the fiscal year ended June 30, 2018, the Archdiocese has reduced its underfunded balance sheet obligations by $271.9 million over the course of six years.

Analysis of Fiscal Year Ended June 30, 2018

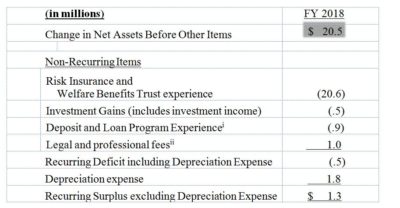

The analysis below presents the “Change in Net Assets Before Other Items” for the year ended June 30, 2018. This amount (i.e. the $20.5 million surplus shaded below) can be found in the Statement of Activities and Changes in Net Assets under the caption “Change in Net Assets Before Other Items” in the “Unrestricted” column (the actual amount is $20,459,862 which has been rounded to $20.5 million in the presentation below). We believe that the analysis presented below provides a meaningful disclosure of results after adjusting for the impact of items that are non-recurring in nature.

The “Recurring Surplus excluding Depreciation Expense” caption above represents what we refer to as our “core” (excludes items of a non-recurring nature and depreciation) operating result.

In the narrative that we published in connection with our results for the fiscal year ended June 30, 2017 we noted then, when referencing the $1.7 million core run rate deficit incurred, that we did take specific actions to deliver a break-even result in the near term. Specifically, we noted that we had fully funded the priests’ retirement plans, allowing us to reduce the amounts charged for these benefits. We also increased the assessment charged to parishes. These actions allowed us to achieve a positive result for the year ended June 30, 2018.

Discussion of Other Significant Matters

In connection with our recent financial disclosures we have provided specific commentary regarding certain balance sheet obligations. As of June 30, 2018 the following balance sheet obligations remain underfunded:

- Deposit and Loan Program Trust

- Lay Employees’ Retirement Plan

Please find an update as of June 30, 2018 for each of these obligations below.

Deposit and Loan Program[iii]

Included in the financial statements for the Office for Financial Services are all assets and liabilities of the Archdiocese of Philadelphia Deposit and Loan Program Trust Fund (“Deposit and Loan Program Trust” or “D&L”). The Deposit and Loan Program Trust is a separate legal entity that provided a deposit and loan program for the benefit of parishes to assure continuation of the ecclesial goals of the Archdiocese and the parishes. Parish funds on deposit in the Deposit and Loan Program Trust receive a competitive interest rate. Historically these funds have been loaned to other parishes for construction and other projects. As noted in endnote “iii” below effective on February 17, 2017, the trustees of the D&L instituted a moratorium on accepting deposits, opening new accounts and making new loans.

In May 2012, the Archdiocese executed a promissory note to the Deposit and Loan Program Trust. In May 2013, the Promissory note was amended to increase the amount of the note to $82 million, which represented the excess of deposits over assets as of June 30, 2012. The promissory note is collateralized by specific pledged real estate assets which are documented in the note. As pledged properties are sold or monetized, net proceeds from these collateral transactions will be deposited into the Deposit and Loan Program Trust, in accordance with the provisions of the promissory note. In the event a transaction generates in excess of $20 million in net proceeds, the Archdiocese has discretion regarding alternative uses for the excess so long as remaining pledged assets are at least equal to the then outstanding principal amount owed.

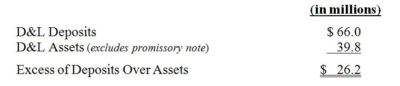

As of June 30, 2018 the underfunded obligation (i.e. the excess of deposits over assets) in the Deposit and Loan Program Trust was as follows:

As of June 30, 2018 the balance outstanding on the promissory note was $32,100,393, which is greater than the underfunded obligation noted above.

The Sproul Road property in Marple Township (Delaware County) is pledged as part of the promissory note. We estimate that the value associated with the Sproul Road property and other pledged properties will be sufficient to resolve the remaining underfunded obligation in the Deposit and Loan Program Trust.

Lay Employees’ Retirement Plan

The Lay Employees’ Retirement Plan (LERP) is considered a multiemployer plan for financial reporting purposes. As such, the assets and actuarially determined liabilities for this plan are not included in the OFS financial statements. The Archdiocese froze this defined benefit pension plan effective June 30, 2014.

While not a direct liability of OFS the amount by which the plan liability exceeds plan assets is a liability of the Archdiocese. The preliminary estimate of the actuarially determined liability for this plan as of June 30, 2018 was $602.4 million.

When the estimated liability is compared to plan assets available for benefits as of June 30, 2018 (approximately $521.5 million), the plan’s shortfall is approximately $81 million. The funded status of the LERP as of June 30, 2018 has improved to 86.6%, versus 82.1% as of June 30, 2017.

Looking Forward[iv]

The core operating deficit has been stabilized significantly since FY 2012’s deficit of $17.6 million. As noted earlier, we have taken steps to improve our operating results in the near term and we expect to achieve a break-even or better core operating result in our fiscal year ended June 30, 2018.

As noted earlier, we estimate that the value associated with properties pledged for the Deposit and Loan Program promissory note is sufficient to resolve the remaining underfunded obligation once those properties are sold.

Going forward our remaining balance sheet issue will be the underfunded Lay Employees’ Retirement Plan. We have taken the following significant steps to address the Lay Employees’ Retirement Plan:

- froze the plan effective June 30, 2014;

- completed more than $100 million of lump sum distributions in calendar year 2015 to eligible participants at a rate equivalent to 85.1% of the present value of their normal retirement benefit;

- made an unplanned contribution of $7.5 million during the year ended June 30, 2016 and an unplanned contribution of $30 million during the year ended June 30, 2017;

- instituted an on-going lump sum distribution program effective October 1, 2017. During the year ended June 30, 2018 lump sum distributions totaling $5.6 million were made to 306 eligible participants, at their election, at a rate equivalent to 82.1% of the present value of their normal retirement benefit;

- increased the funding rate to 5.9%, from 4%, of “pension eligible payroll” effective July 1, 2016. Based on the most recently completed actuarial valuation for the plan (as of July 1, 2018), if we maintain a funding rate of 5.9%, and all other actuarial assumptions are achieved, the plan should be fully funded in just under 10 years.

Additional Financial Statements for the Fiscal Year Ended June 30, 2018

The audited financial statements for OFS do not include financial results for the Office of Catholic Education, Catholic Healthcare Services, Catholic Social Services, Saint Charles Borromeo Seminary, Catholic Charities Appeal or the Heritage of Faith—Vision of Hope Capital Campaign as all are separate entities. Audited financial statements for these entities will be published in the coming weeks.

Additionally, none of the reports released by the Archdiocese include financial statements for individual parishes. All parishes are independent and autonomous entities.

# # #

Editor’s Note: A complete copy of the audited financial statements for the Office for Financial Services can be found at www.CatholicPhilly.com.

Endnotes

[i] The experience of the Risk Insurance and Welfare Benefits Trusts and the Deposit and Loan Program Trust should be considered separately and treated as non-recurring. The assets in these trusts are not available for general operating needs.

[ii] Primarily includes legal and professional fees incurred related to the following, in process as of June 30, 2018, real estate transactions: Sproul Road ($106,000), the Cathedral Block ($280,000), and the Newman Center property serving the University of Pennsylvania and Drexel University Catholic Communities ($490,000). Note that the sale of the Newman Center property closed in September 2018 as disclosed in Note S of the Financial Statements.

[iii] As disclosed in the audited financial statements, effective February 17, 2017 the trustees of the D&L instituted a moratorium on accepting deposits, opening new accounts and making new loans under the program. During the year ended June 30, 2017, the trustees implemented a distribution from the D&L of parish cemetery perpetual care funds and endowment funds so that these balances could be more appropriately invested. Cash distributions, equal to 20% of depositor balances, were also made to each depositor. During the year ended June 30, 2018 all depositors’ balances less than $12,500 were fully distributed to depositors. Further, cash distributions equal to 17.5% of remaining balances, were also made to each depositor.

[iv] As disclosed separately, the Archdiocese is creating an independent, voluntary program to provide assistance and compensation to survivors of sexual abuse by clergy of the Archdiocese of Philadelphia. While the ultimate payout from such a program cannot be reasonably estimated currently, management of the Archdiocese expects the amount required to be in excess of available liquidity meaning borrowing and sales of assets will be necessary to fund the program.

Contact:Contact: Kenneth A. Gavin

Chief Communications Officer

215-587-3747 (office)